Types of Medical Underwriting- Moratorium Vs. Full

Have you heard the terms full or moratorium when exploring more about medical underwriting? Ever wondered what they are. We’ll tell you in a jiffy. But first, let us tell you what medical underwriting is. In simple terms, it is a process used by health insurers to decide the price and terms of insurance policies. The process is done by analyzing current and anticipated medical needs of a person.

What is Moratorium Underwriting?

It includes setting a waiting period for pre-existing medical conditions to limit the risk to an insurance provider. This is a good method that helps insurers to keep premiums affordable for members of a plan. A moratorium will not include any pre-existing health conditions for a set period of time, usually two years. After that period ends, it may cover health conditions that come after.

Let’s take an example

If Roger has been suffering from eczema 24 months before his plan started, this disease and any recurring expenses won’t be covered until Roger is free of symptoms and treatment for 24 months after the start day of Roger’s plan.

What is Full Medical Underwriting?

As the name suggests, it involves full disclosure of any and all medical conditions and history by the insurance seeker via a full declaration. The insurance company will then decide whether it can cover those health conditions or not. The underwriting process is somewhat complex and the premiums are high if you have several medical issues or a family history of many health issues and the insurer covers it.

In many cases, the insurer would agree to cover only a few health conditions and, in many cases, the insurer will simply decline to cover any of those. If special terms are applied in your case, it will be visible on your certificate of insurance and the cover will usually be governed by terms and conditions and benefits of your plan.

Moratorium Vs. Full Underwriting: Which One Should You Select?

The choice depends on many factors. Some of them are:

- Your medical history

- Your current medical condition

- Any other medical condition you might be vulnerable to

- Your personal choice

- Your finances

We suggest that you talk to an expert or an advisor regarding which option is best for your situation as there is no “one size fits all” solution here. The other option is to contact different insurers yourself and decide what method meets your needs.

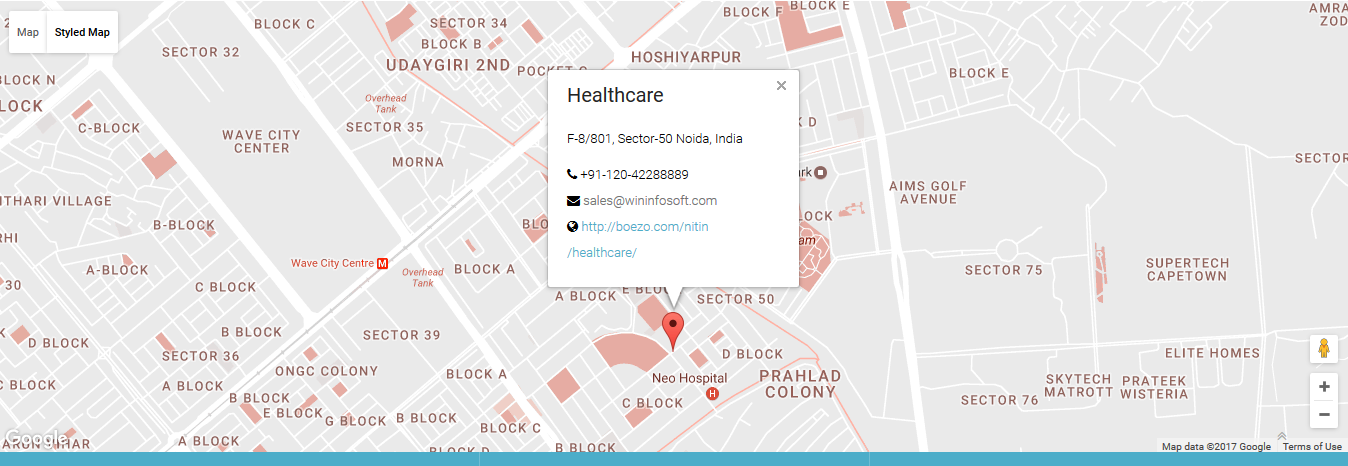

Now, if you are interested in hiring top medical underwriters, contact Win Healthcare. We have a team of experts who can create amazing content on the basis of facts and data so that insurance doesn’t cost you too much!