- Win Infosoft’s experts have abilities in accurately and quickly assessing complex data to ensure timely project completion without errors.

- We produce solid and reliable information that eases your decision making process and makes it smoother.

- Keeping up with all the latest trends in the underwriting industry is our forte that helps us to satisfy our customers time and again.

- All of us work cooperatively to ensure that the underwriting process is always successful. No errors ever!!

- Swift working is another of our assets. We can start working on the underwriting process as soon as the agents make a sale.

Medical Underwriting Service

Medical underwriting is a common health insurance term that refers to using medical or health information while evaluating an applicant for life or health insurance coverage. Underwriting helps the insurer to know the risk presented by an applicant so that the insurer can make sure that the premium is in proportion to the level of risk.

Which Factors are Assessed?

A competent underwriting expert or team would evaluate the health, lifestyle, occupation and many additional factors while deciding the risk level.

The Definition of Medical Underwriter in the Insurance Industry

The process of understanding and then quantifying the risk associated with the health insurance is done by a medical underwriter in the Insurance industry. The underwriter determines the risks related faced by the insurance company by analyzing several factors like gender, age, lifestyle, etc. If the medical underwriting is not done with precision, the insurance companies may have to face severe losses.

Win Infosoft is a renowned provider of medical underwriting service and we cater to varied medical and life insurance companies that are seeking an objective rating methodology offered by a third-party for underwriting the health and life insurance policies.

We have developed a state-of-the-art underwriting or claims system that evaluates the submitted information by making use of conventional medical questionnaires for individuals who are applying for medical, disability or life insurance policies.

The applications are automatically assigned a point total that is predicted upon the potential claim exposure of any applicant. Several areas are extremely cross-referenced that includes the prior or current medical conditions, lifestyles, family history, medications, occupational exposures, etc.

Research has unveiled the fact that scientific cross-referencing of related conditions produces a better assessment of the potential exposure as compared to the evaluation done on an individual or a condition by condition basis. The final point total helps in determining whether the applicant is insurable or not. It also helps in deciding whether the applicant should be surcharged or have a few exposures excluded at the time of issuance of the policy.

The team of Win Infosoft is deft at customizing an outsourced underwriting solution to meet the needs of the clients. Medical Underwriting is our key service and we are experts on different kinds of underwriting processes. All the risk-assessment underwriting experts working for us will leave no question unanswered and will never leave a box unchecked.

Our expertise lies in anticipating and avoiding costly delays that are often results of incomplete or missing information. We also bring our underwriting insight and perspective to each of the clients we serve and support.

Trust our underwriting team to accurately assess the risk of each applicant and allow your agents to focus on sales & superior customer service.

Hire Win Infosoft to make medical underwriting an easier, uncomplicated and value for money task.

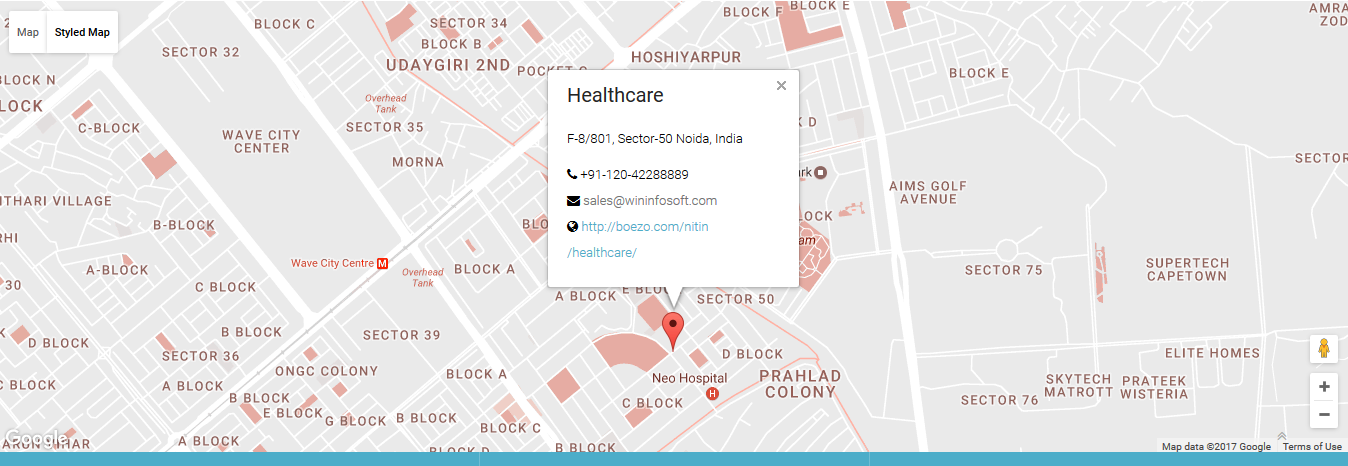

© 2017 Healthcare. All rights reserved.